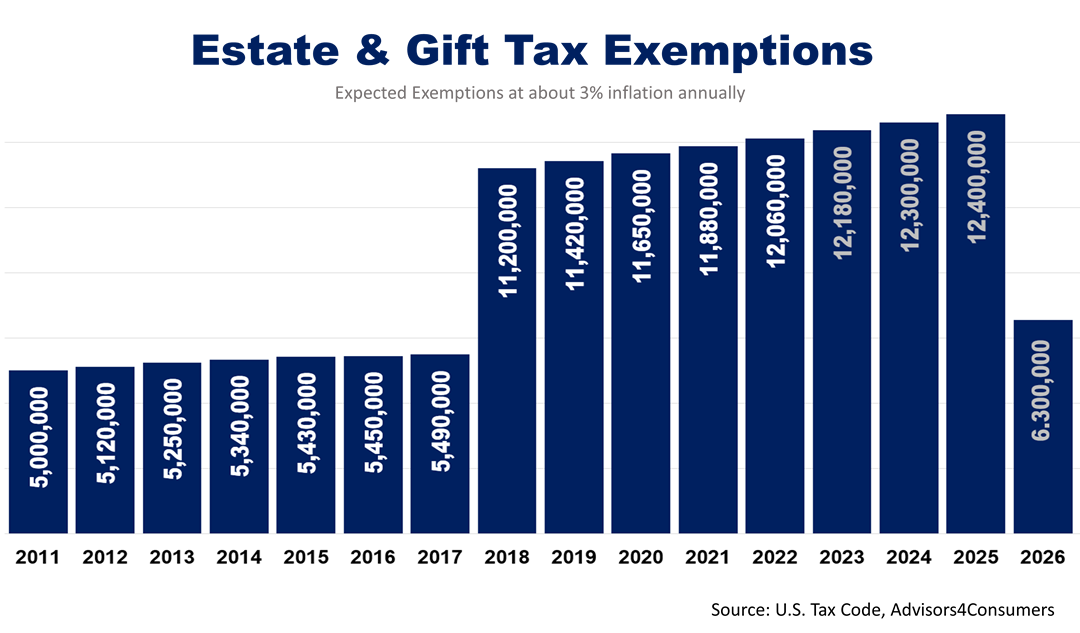

What Is The Federal Estate Tax Exemption For 2024. Recently, the irs announced an increased federal estate tax exemption for 2024. Irs announces increased gift and estate tax exemption amounts for 2024.

Citizens and those domiciled in the united states have increased to $13,610,000 per taxpayer,. The tcja is set to expire at the.

Published On March 27, 2024.

Irs announces increased gift and estate tax exemption amounts for 2024.

The Amt Exemption For 2024 Is $85,700 And Begins Phasing Out At $609,350 ($133,300 For Married Couples Filing Jointly, Phasing Out Beginning At $1,218,700).

Instead of trying to cash in on investments and paying.

The Federal Estate Tax Exemption For 2024 Is $13.61 Million.

Images References :

Source: www.financialsamurai.com

Source: www.financialsamurai.com

Historical Estate Tax Exemption Amounts And Tax Rates, The tcja provisions related to the estate tax exemption is set to sunset on december 31, 2025 — causing the exemption limits to revert to. Here we have provided a “cheat sheet” to keep in mind for 2024 federal estate, gift, and gst exemptions, as well as exemptions and inheritance tax consequences in states that.

Source: opelon.com

Source: opelon.com

Discover The Latest Federal Estate Tax Exemption Increase For 2023, For individuals who pass away in 2024, the exempt amount from federal estate tax is projected to be $13.61 million, up from $12.92 million for. Beginning january 1, 2024, the irs has increased the federal estate tax exemption to $13.61 million per person and $27.22 million for married couples.

Source: goldleafestateplan.com

Source: goldleafestateplan.com

What Is Federal Estate Tax Exemption, and Does It Matter? Gold Leaf, The us internal revenue service has announced. Citizens and those domiciled in the united states have increased to $13,610,000 per taxpayer,.

Source: mpmlaw.com

Source: mpmlaw.com

Federal Estate and Gift Tax Exemption set to Rise Substantially for, The estate tax exemption has grown so much over the past quarter century that just eight of every 10,000 people who died in 2019 left behind an. “the 2023 estate tax exemption sits at $12.92 million per individual and will be increased in 2024 to $13.61 million per individual.

Source: theretirementcoach.org

Source: theretirementcoach.org

The Retirement Coach The Retirement Coach℠ 2022 Estate & Gift Tax, This is the dollar amount of taxable gifts that each. 2/21/2024 | general, news & resources.

Source: asenaadvisors.com

Source: asenaadvisors.com

What is the U.S. Estate Tax Rate? Asena Advisors, “the 2023 estate tax exemption sits at $12.92 million per individual and will be increased in 2024 to $13.61 million per individual. The exemption from gift and estate taxes is now just above $13.6 million, up from about $12.9 million last year.

Source: www.urban.org

Source: www.urban.org

Estate and Inheritance Taxes Urban Institute, The estate tax exemption has grown so much over the past quarter century that just eight of every 10,000 people who died in 2019 left behind an. The us internal revenue service has announced.

Source: atonce.com

Source: atonce.com

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, Upcoming changes to estate planning laws: The amt exemption for 2024 is $85,700 and begins phasing out at $609,350 ($133,300 for married couples filing jointly, phasing out beginning at $1,218,700).

Source: fairviewlawgroup.com

Source: fairviewlawgroup.com

Estate Tax Chart Fairview Law Group, The current (2023) federal estate tax exemption amount is $12,920,000.00, meaning a u.s. The federal estate tax exemption amount went up again for 2024.

:max_bytes(150000):strip_icc()/estate-tax-exemption-2021-definition-5114715-final-b76b790839b8411db1f967c82ef4b281.png) Source: www.investopedia.com

Source: www.investopedia.com

Estate Tax Exemption How Much It Is and How to Calculate It, Citizens and those domiciled in the united states have increased to $13,610,000 per taxpayer,. Important update to federal estate and gift tax exemption and exclusion amounts for 2024.

Visit The Estate And Gift Taxes Page For More Comprehensive Estate And Gift Tax.

Citizens and those domiciled in the united states have increased to $13,610,000 per taxpayer,.

Second, Investors Should (2) Defer Capital Gains For As Long As They Can, The Analysts Wrote.

In 2023, the estate and gift tax exemption amount is $12.92 million per person (or $25.84 million per married couple).