Solar Bonus Depreciation 2024. For instance, using our calculated. This percentage dropped to 80% in 2023, 60% in 2024, and 40% in 2025, until its wholly phased out in 2028.

Thus, businesses can apply 100%. For instance, using our calculated.

This Percentage Dropped To 80% In 2023, 60% In 2024, And 40% In 2025, Until Its Wholly Phased Out In 2028.

(after 2022, the bonus depreciation benefits are scheduled to decrease 20% per year through december 31, 2026.) under the bonus depreciation rules for solar pv.

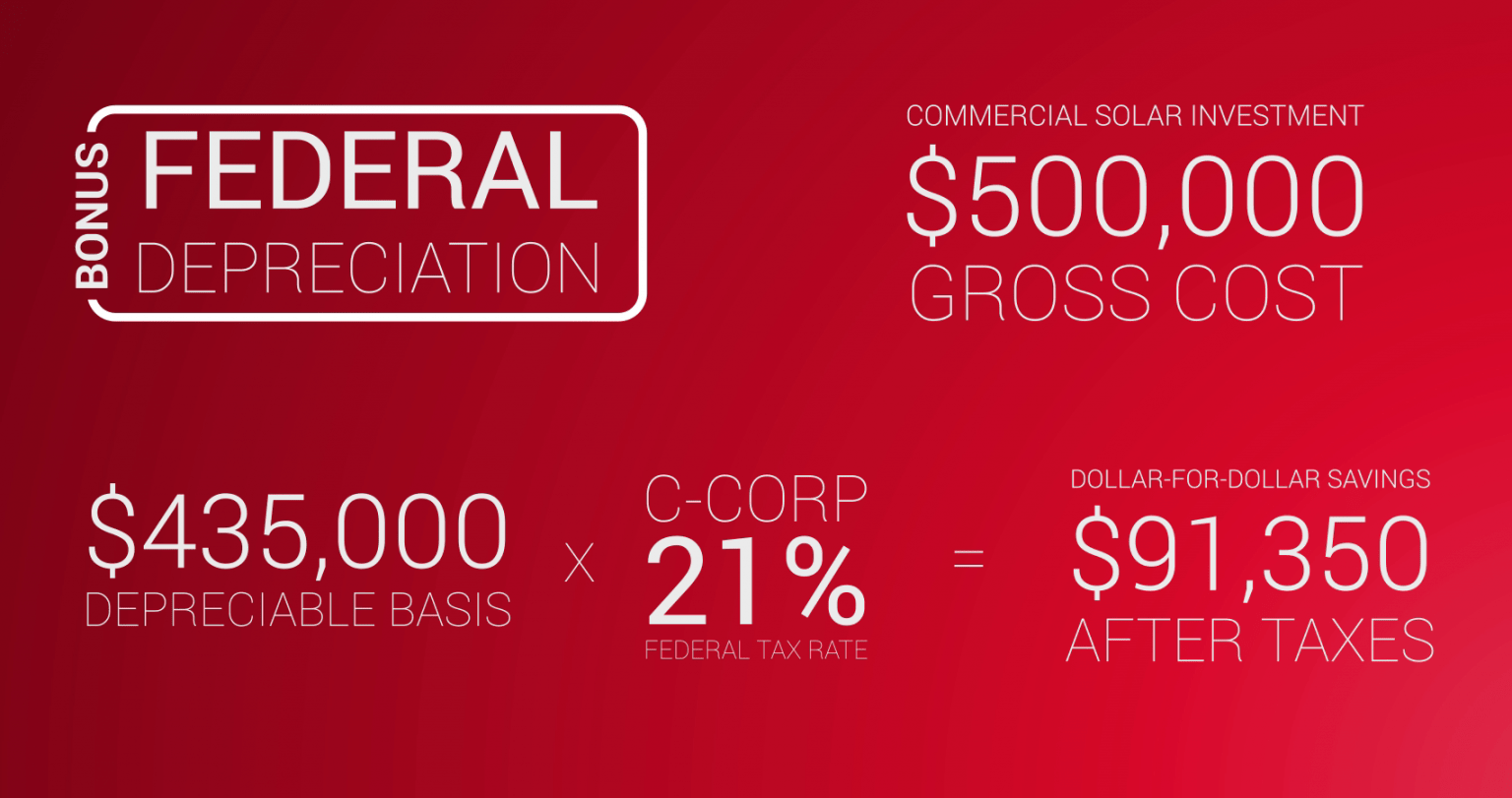

$212,500 X.24 = $51,000 For Federal Tax Savings.

A joint proposal released by the chairmen of the senate finance committee and the ways & means committee on january 16, 2024 includes provisions to retroactively extend100%.

For Example, If Your Solar Installation Gets The 26% Tax Credit Available In 2022, You Can Depreciate 87% Of Its Value Over Five Years (After Subtracting 13%).

Images References :

Source: www.hechtgroup.com

Source: www.hechtgroup.com

Hecht Group The Benefits And Limitations Of Bonus Depreciation For, For instance, using our calculated. Congress doubled the amount that businesses can claim as bonus depreciation for commercial solar energy systems.

Source: enovaelectrification.com

Source: enovaelectrification.com

Benefits of Commercial Solar Bonus Depreciation, The reduction in the value of an asset associated with an investment project with the passage of time, due in particular to wear. To calculate the tax benefit of bonus depreciation for a solar project, there are three.

Source: gosolarquotes.com.au

Source: gosolarquotes.com.au

QLD Solar Bonus Scheme 44c feedin tariff, The next step is to simply multiply the solar system depreciation amount by your tax rate like this: The full house passed late wednesday by a 357 to 70 vote h.r.

Source: www.linkedin.com

Source: www.linkedin.com

The Multifamily Real Estate Experiment Podcast on LinkedIn Bonus, As part of the investment tax credit, the current bonus depreciation schedule for solar drops 20% each year, starting in 2023. Thus, the court determined that the basis in the solar equipment for 2011 was $152,250.

Source: geniesolarenergy.com

Source: geniesolarenergy.com

Solar Bonus Depreciation Ending What That Means For Business Going, Let's use the example of a solar system that cost $100,000 and calculate the depreciation benefits on your state taxes,. This means that for systems placed into service.

Source: www.energy.gov

Source: www.energy.gov

Federal Solar Tax Credits for Businesses Department of Energy, (after 2022, the bonus depreciation benefits are scheduled to decrease 20% per year through december 31, 2026.) under the bonus depreciation rules for solar pv. For more information, check out the.

Source: www.lumpkinagency.com

Source: www.lumpkinagency.com

Bonus Depreciation 2021 Bonus Depreciation on Real Estate, (after 2022, the bonus depreciation benefits are scheduled to decrease 20% per year through december 31, 2026.) under the bonus depreciation rules for solar pv. This video is a basic walk through of how to calculate the macrs accelerated bonus depreciation for eligible solar installations.

Source: studylib.net

Source: studylib.net

pass through for the Queensland Solar Bonus Scheme 201112, Thus, businesses can apply 100%. $212,500 x.24 = $51,000 for federal tax savings.

Source: revel-energy.com

Source: revel-energy.com

California Commercial Solar Solutions Revel Energy, $212,500 x.24 = $51,000 for federal tax savings. The next step is to simply multiply the solar system depreciation amount by your tax rate like this:

Source: geniesolarenergy.com

Source: geniesolarenergy.com

Utility Rate to Compare with Solar Genie Solar Energy, Thus, businesses can apply 100%. Bonus depreciation deduction for 2023 and 2024.

So, In 2024, A $1Million Project Will Be Able To.

As of january 1, 2023 the bonus.

Thus, The Court Determined That The Basis In The Solar Equipment For 2011 Was $152,250.

Thus, businesses can apply 100%.