2024 Roth Ira Income Phase Out. Ira contribution limits for 2024. Here's an overview of the income.

If you’re at least 50 years old you can save an additional. Here are the phase out ranges for 2024.

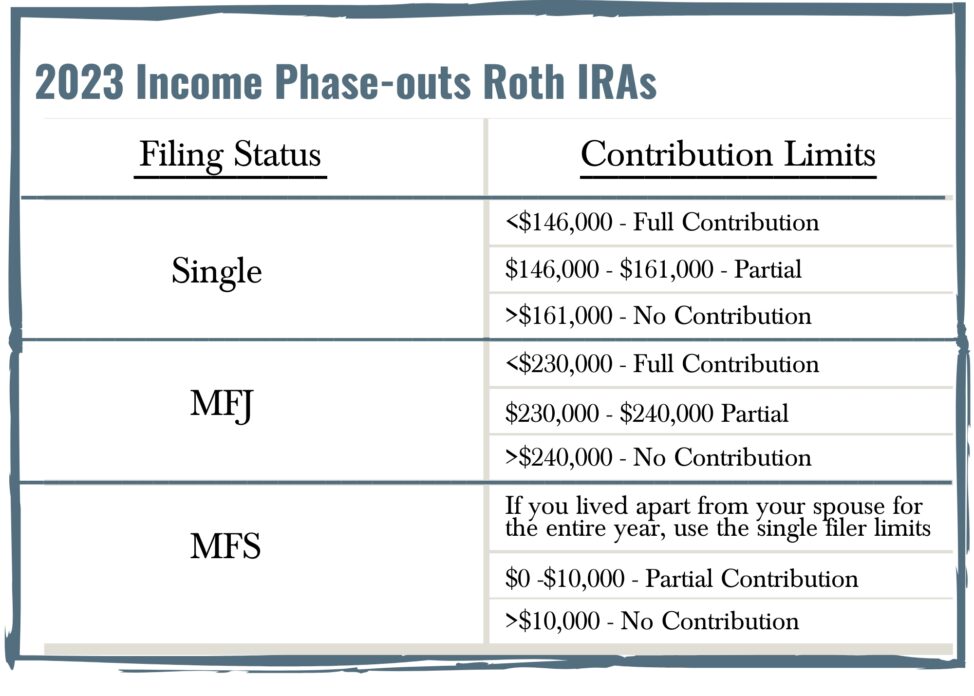

In Tax Year 2023, You May Contribute Up To $6,500 To A Roth Ira, Or $7,500 If You Are 50 Or Older.

Whether or not you can make the maximum roth ira contribution (for 2024 $7,000 annually, or $8,000 if you're age 50 or older) depends on your tax filing status and your.

2024 Roth Ira Income And Contribution Limits.

The contribution limit for a roth ira is $6,500 (or $7,500 if you are over 50) in 2023.

A Roth Ira Phaseout Limit Is The Income Level At Which Your Contribution Can Be Reduced Or Phased Out Completely.

Images References :

Source: annadianawjoana.pages.dev

Source: annadianawjoana.pages.dev

Tax Rules 2024 Retha Martguerita, Contribution limits are enforced across traditional iras and roth iras, but income limits only apply to roth. Here's an overview of the income.

Source: priscawelana.pages.dev

Source: priscawelana.pages.dev

Acp Limits For 2024 Addie Anstice, Ira contribution limits for 2024. The maximum amount you can contribute to a roth ira for 2024 is $7,000 (up from $6,500 in 2023) if you're.

Source: shannawsonja.pages.dev

Source: shannawsonja.pages.dev

2024 Roth Ira Limits Trude Hortense, The same combined contribution limit applies to all of your roth and traditional iras. Contribution limits are enforced across traditional iras and roth iras, but income limits only apply to roth.

Source: shannawsonja.pages.dev

Source: shannawsonja.pages.dev

2024 Roth Ira Limits Trude Hortense, Use this free roth ira calculator to estimate your roth ira balance at retirement and calculate how much you are eligible to contribute to a roth ira account in 2024. If you’re at least 50 years old you can save an additional.

Source: time.com

Source: time.com

Roth IRA Contribution and Limits 2023/2024 TIME Stamped, The ira contribution limits for 2024 are $7,000 for those under age 50, and $8,000 for those age 50 or older. Subtract from the amount in (1):

Source: www.theentrustgroup.com

Source: www.theentrustgroup.com

IRS Unveils Increased 2024 IRA Contribution Limits, Use this free roth ira calculator to estimate your roth ira balance at retirement and calculate how much you are eligible to contribute to a roth ira account in 2024. This table shows whether your contribution to a roth ira is affected by the amount of your modified agi as computed for roth ira purpose.

Source: www.greatoakadvisors.com

Source: www.greatoakadvisors.com

2024 Roth IRA Phaseouts Great Oak Wealth Management, Whether or not you can make the maximum roth ira contribution (for 2024 $7,000 annually, or $8,000 if you're age 50 or older) depends on your tax filing status and your. You're allowed to invest $7,000 (or $8,000 if you're 50 or older) in 2024.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

Roth IRA Limits And Maximum Contribution For 2021, This table shows whether your contribution to a roth ira is affected by the amount of your modified agi as computed for roth ira purpose. Those limits reflect an increase of $500 over the.

Source: joleenwbianka.pages.dev

Source: joleenwbianka.pages.dev

Tax Deductible Ira Limits 2024 Brooke Cassandre, The ira contribution limits for 2024 are $7,000 for those under age 50, and $8,000 for those age 50 or older. Limits on roth ira contributions based on modified agi.

Source: www.blog.passive-income4u.com

Source: www.blog.passive-income4u.com

IRA Contribution Limits And Limits For 2023 And 2024, In tax year 2023, you may contribute up to $6,500 to a roth ira, or $7,500 if you are 50 or older. The roth ira income limits will increase in 2024.

You're Allowed To Invest $7,000 (Or $8,000 If You're 50 Or Older) In 2024.

The roth ira income limits will increase in 2024.

12 Rows If You File Taxes As A Single Person, Your Modified Adjusted Gross Income.

The income limit to contribute the full amount to a roth ira in 2024 is $146,000, up from $138,000 in 2023.